900+ Happy Customers Worldwide : Launch Your Own Funding Company with Our All-In-One Software Solution

Get Instant Access Here

COMPLETE YOUR PURCHASE TO GET INSTANT ACCESS TO YOUR SNAPSHOT

🏦 What Is It?

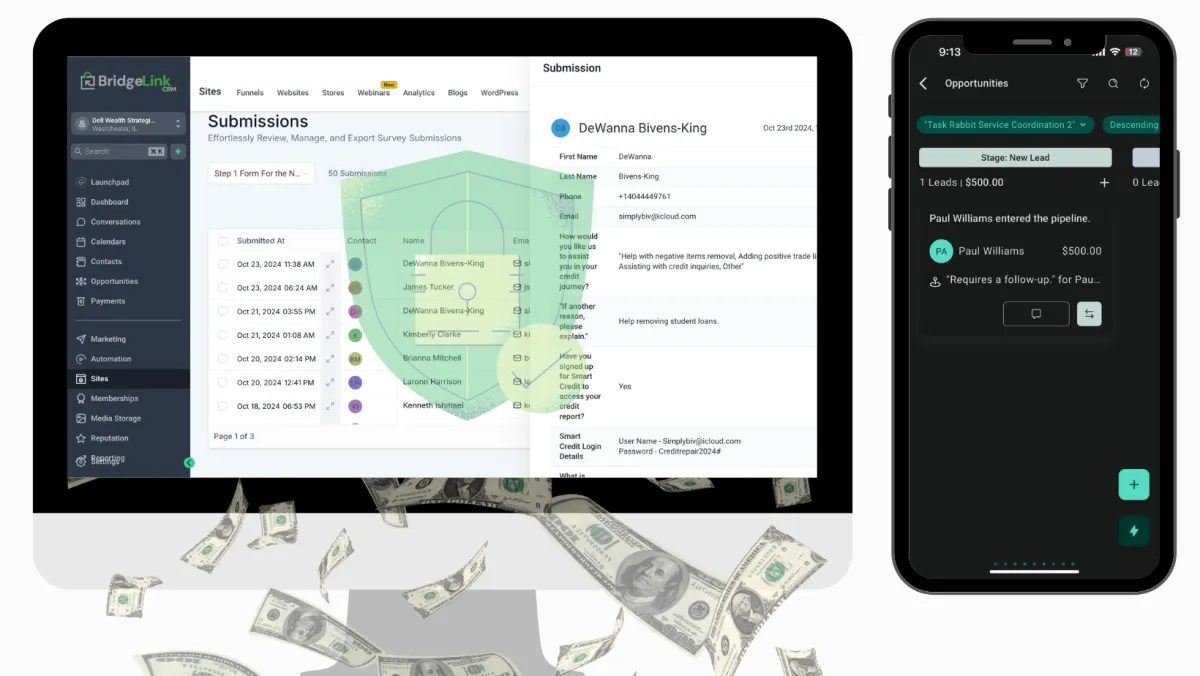

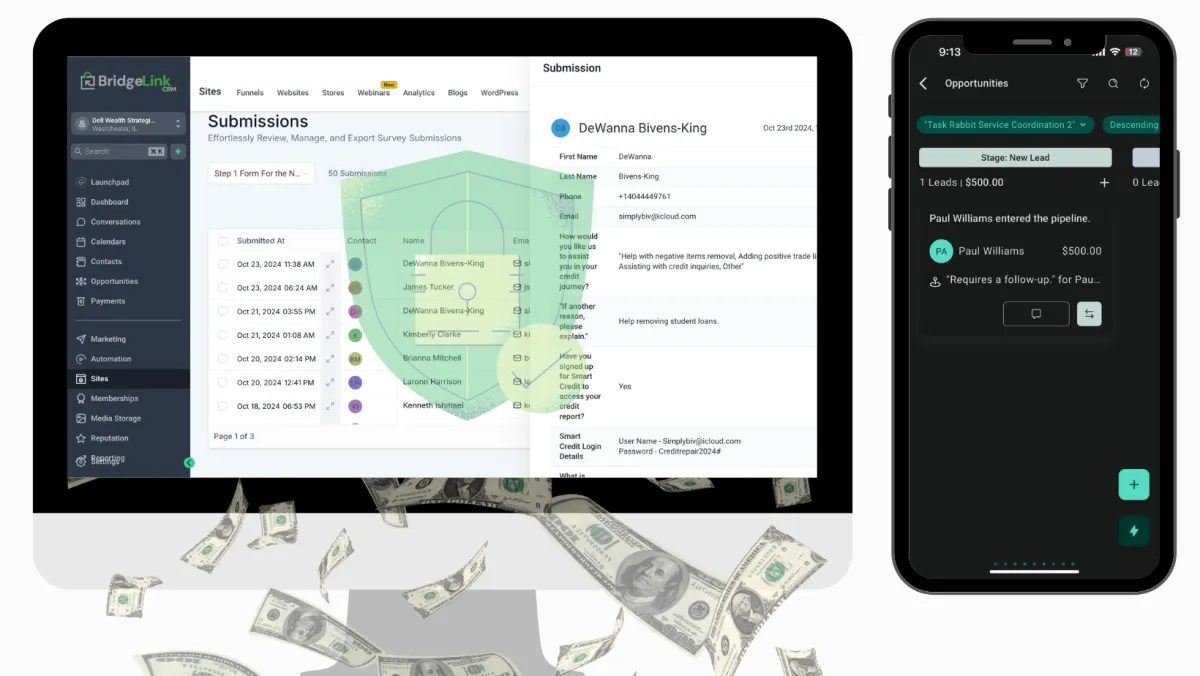

Our software is a complete business-in-a-box built to help you launch and operate your own funding company — even if you’re starting with no experience. Why This Package is a Game-Changer?

Whether you’re helping clients get credit card funding, personal loans, or business lines of credit, this platform automates every step from lead capture to payment collection, making it easy to manage dozens (or even hundreds) of clients.

✅ Who Is This For?

Entrepreneurs looking to start a funding business Credit repair professionals wanting to offer funding Business coaches who want to help clients access capital Anyone with a network and drive to help others get funded

🔧 Key Features

📋 1. Client Application Portal Easily collect client info, financials, and credit data through a secure intake form.

🧠 2. Credit Report Integration Clients connect their SmartCredit account, so you can analyze their reports in real-time and instantly know if they qualify.

📝 3. Automated Pre-Qualification System System tags clients as “Fundable,” “Needs Repair,” or “Needs More Info” so you know exactly how to help them.

🧩 4. Custom Funding Game Plans Quickly generate a funding plan based on each client’s credit profile — showing what cards, banks, or programs to apply to.

🔧 More Key Features

🤝 5. Contract Management Send pre-built funding contracts and agreements with built-in e-signatures. Everything is time-stamped and saved.

💳 6. Merchant-Ready for Payments Collect backend success fees through Stripe, PayPal, or ACH. The system can even charge in split payments automatically.

🔁 7. Pipeline Management Track clients through each phase: Onboarding → Credit Review → Funding Plan → Application → Approval → Payout

🧑💻 8. Team Access + Roles Assign roles for credit specialists, sales reps, and funding advisors. Manage permissions and monitor performance.

🔓 Ready to Launch Your Own Funding Business?

BridgeLinkCRM Funding Company businesses in a box

$1000 Sign-Up Fee & $50 Subscription Plan Cancel Anytime

STILL HAVE QUESTIONS?

Frequently Asked Questions

What exactly does this software do?

This software gives you all the tools you need to start and run your own funding company. From onboarding clients, reviewing their credit, creating funding plans, collecting payments, and tracking results — everything is managed inside one system.

Do I need to be experienced in credit or funding to use this?

Nope. The system was designed for beginners and pros alike. We include step-by-step training, templates, scripts, and even automation — so you can learn as you go and look like a professional from Day 1.

Can I brand this software as my own?

Yes! The software is white-labeled, which means you can brand it with your own business name, logo, and domain. You’re building your own company — not someone else’s.

How does the software get my client’s credit report?

Your client connects their Smart Credit account during onboarding. The system then pulls their credit report securely into your dashboard so you can review their score, tradelines, utilization, inquiries, and negatives in real time.

How do I know if a client is fundable?

The system auto-tags clients based on their credit profile. If they’re ready for funding, it lets you know. If not, it will tell you what needs to be fixed first — like paying down balances, removing inquiries, or adding tradelines.

What if a client needs credit repair first?

No problem. You can plug them into your own credit repair services or use our tools and partnerships (like MyDisputeFlow.com) to handle their disputes. The software is designed to make you money at every stage — not just funding.

How do I get paid?

You can set up Stripe, PayPal, or ACH to accept payments directly inside the system. Charge clients upfront for your services or take a backend fee after you help them get approved. You control the pricing and payment terms.

What banks and lenders does this work with?

This system works with any bank, credit union, or lender. You’ll be creating funding plans based on your client’s credit profile and applying directly to the lenders — the software helps organize, track, and guide the process.

Can I add team members or partners?

Yes. You can add staff, partners, or virtual assistants with different access levels. That way your sales reps, credit pros, or assistants only see what they need to manage — while you stay in full control.

Is training included?

Yes. We include complete walkthroughs, video training, cheat sheets, templates, and even live support to help you hit the ground running. We also have mentorship upgrades for those who want to scale fast.

How much money can I make with this?

That depends on your hustle, but most users charge $250–$950 upfront per client, and 10%–20% on the backend of what they get funded. Just 10 clients funded at $25K = $25K in backend profit alone 💰

Can I use this if I already have a credit repair business?

Absolutely. This is the perfect add-on to any credit repair or business coaching offer. You can cross-sell funding and credit-building services to your existing clients and earn more per client without doing extra work.

🎯 Why Our Software?

✔️ Everything in one place- no more juggling spreadsheets contracts and email chats

✔️ Built by funders for funder we've done 7-figures in approvals using this exact system

✔️ Completely white-lableled - brand its a your own and grow your company under your name